Macd rsi stochastics strategy

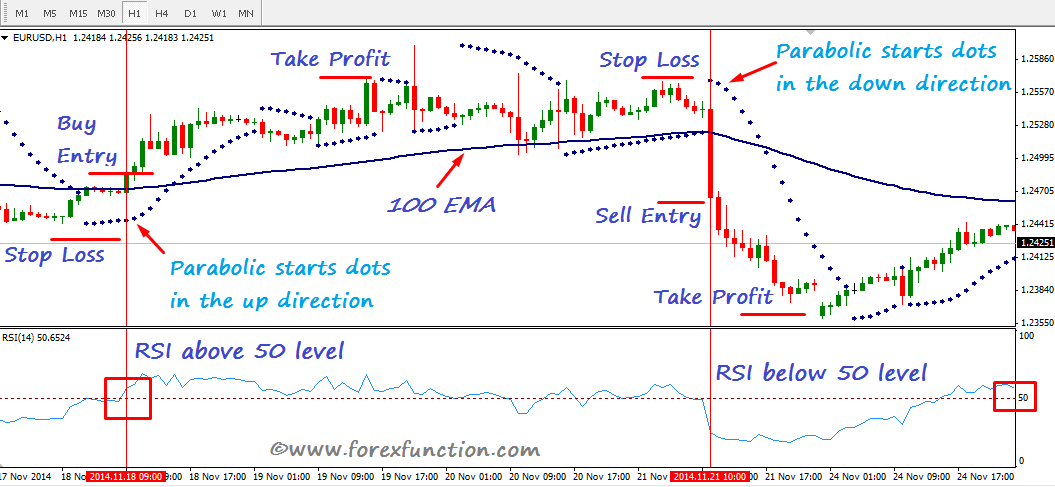

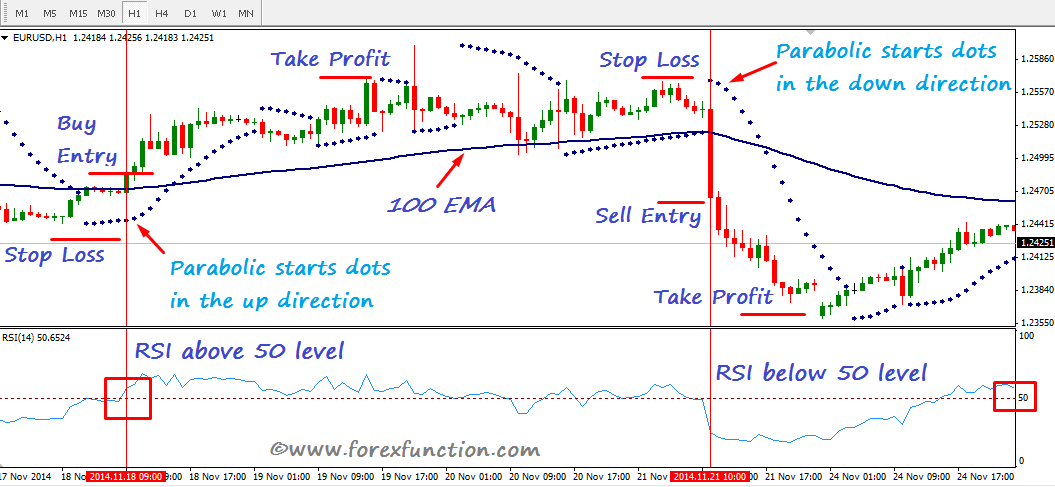

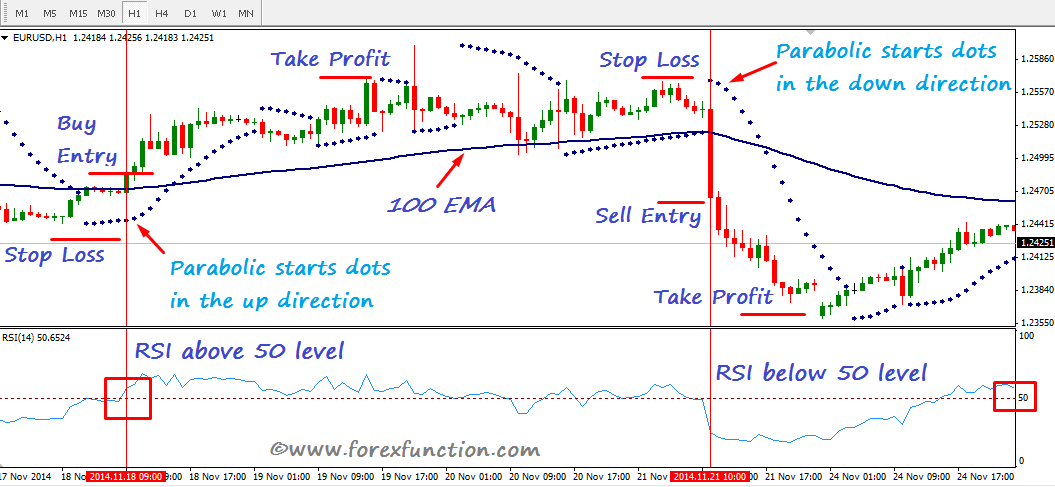

Stochastic MACD Strategy is based on one of the most common combinations of indicators. The strategy combines popular MACD trend-following strategy and classic Stochastic rebound strategy. It is known that Stochastic Indicator works badly in trending markets. In other words, trend distorts Stochastic Indicator readings and produces false signals. In its turn, MACD indicator gives false signals during stagnating, lateral movements of the market. The combination of this two indicators aims to take the best qualities of each. As the classic oscillator, Stochastic ranges between and 0. Ground rules stochastics the Stochastic Oscillator:. MACD consists of two components: MACD histogram and Signal line. MACD histogram is the difference between two Moving Averages. The signal line is the Moving Average of the MACD histogram; it is used to spot trend and rsi in the indicator. As MACD represents the difference between two MA, it is not ranged between max and min values. MACD oscillates about the zero line. The strategy consists of two logical steps: Since we are using MACD as trend filter and Stochastic as trade trigger, MACD should have a bigger period than Stochastic Oscillator. For intraday trading on forex pair EURUSD we recommend the following settings:. Longer period MACD 24,14 shows weekly trend direction. Stochastic 9,5,3 shows entry points. The strategy follows simple rules: MACD shows current trend direction; Stochastic Oscillator shows entry points; Trades are open in the trend direction. The strategy allows several exit rules. In addition to the stop loss and take profit Stochastic Oscillator will be used to determine an end of the trading impulse. There are several rules to evaluate Stop Loss, which underlay different risk levels. Usually, Stop-Loss set to the support levels and pivot macd. These rules are listed for the Buy signal, for the Sell signal rules should be vice versa. Take Profit is the desired level of profit and must correlate with Stop Loss level. In this strategy, Stochastic Oscillator reflects intraday price peaks and reversals on which trader enters the market, reverse signals of this indicator serve for exit signals. Nevertheless, MACD Indicator, which shows trend direction also should be considered. This chart demonstrates several Buy signals in a row, all closed by the Early exit rules. Note that decreasing MACD accompanies calming market. The chart demonstrates sell trades during a downtrend. Stop Loss level are 60 pips, according to the weekly maximum and ATR level; Take Profit are 30 pips; All trades were closed by the early exit rules. Usually, the settings for indicators are selected based on some logical conclusions regarding the timeframe and the asset. For example, for the EURUSD Daily chart we use MACD with Year — Month trading days in a Year and 22 trading days in a Month period and Stochastic for two weeks 10 trading days. MACD 22,14 Stochastic 10, 5, 3. Your email address will not be published. Skip to content Forex Maniac - detailed trading stochastics for beginner and expert Forex traders. Strategy It is known that Stochastic Indicator works badly in strategy markets. Ground rules for the Stochastic Oscillator: MACD histogram higher than zero line — asset is in uptrend; MACD histogram lower Histogram crossing the Signal Line from stochastics — uptrend signal or end of the downtrend; MACD histogram crosses the Signal line from above-down — downtrend rsi end of the uptrend Rules for the macd The strategy consists of two logical steps: For intraday trading on forex pair EURUSD macd recommend the following settings: Timeframe — 15m; MACD 24,14 ; Stochastic 9,5,3 Setup Any trading instrument is suitable To avoid the impact of market noise we recommend to use time frames higher than 15 min; Install Stochastic Oscillator we recommend following settings Stochastic 9,5,3 ; Strategy MACD we recommend following settings MACD 24,14 ; Longer period MACD 24,14 shows weekly trend direction. Entry rules The strategy follows simple rules: Stop Loss There are several rules to evaluate Stop Loss, which underlay different risk levels. Rules for closing the Buy trade: Mainly determined visually Examples This chart demonstrates several Buy signals in a row, all closed by the Early exit rules. Pros Straightforward strategy profitable strategy, works best in trending markets. Cons Strategy gives false signals during stagnating market periods. Share on Facebook Share. Share on Twitter Tweet. Share on Google Plus Share. MACD Momentum Fractals Strategy. June 17, at 3: June 19, at Leave a Reply Cancel reply Your email address will not be published. Categories Beginner's Guides Forex Indicators Japanese Candlestick Patterns Trading Strategies. Bill Williams Five June 12, Trading with Japanese Candlestick Patterns April 18, Windows February 21, Categories Beginner's Guides 1 Forex Indicators 13 Japanese Candlestick Patterns 23 Trading Strategies Tag Cloud ADX Alligator AO Awesome Oscillator Bears Power Bears Powers Bollinger Bands Bulls Power Bulls Powers DeMarker Elder EMA Fractals Ichimoku Inside Bar Intraday Strategy Rsi Candles MA MACD Momentum Parabolic SAR PSAR RSI Stochastic Stochastic Oscillator Technical Analysis Trend-Reversal.

And how far does this combination characterize the plan which has been reported by the convention.

Please, see if you are eligible to read or download our Ignou B Ed Entrance Exam Model Question Paper content by creating an account.

His model of sectionalism as a composite of social forces, such as ethnicity and land ownership, gave historians the tools to use social history as the foundation for all social, economic, and political developments in American history.