Trading indicators stochastics

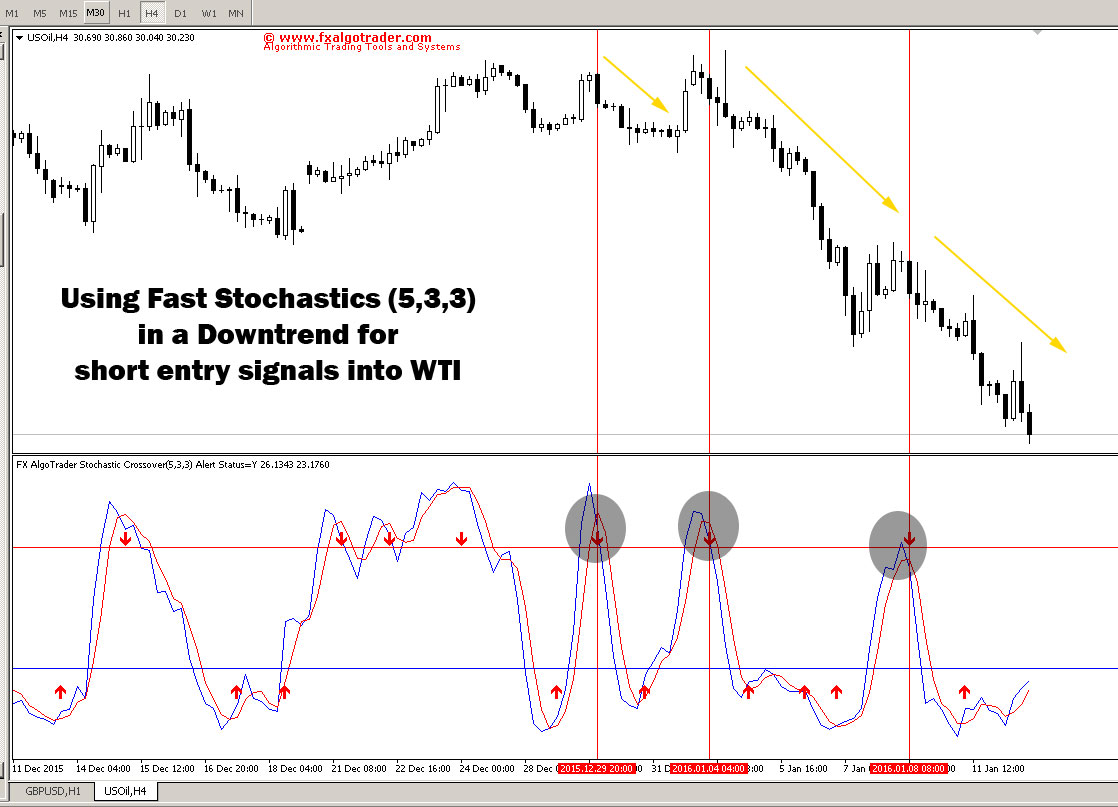

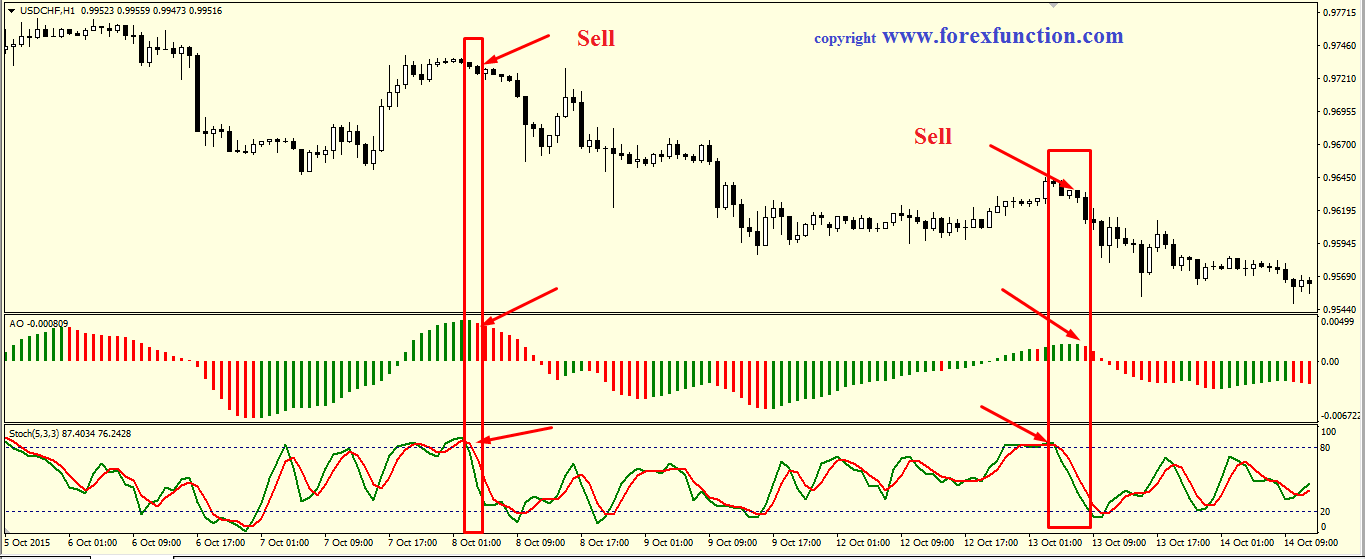

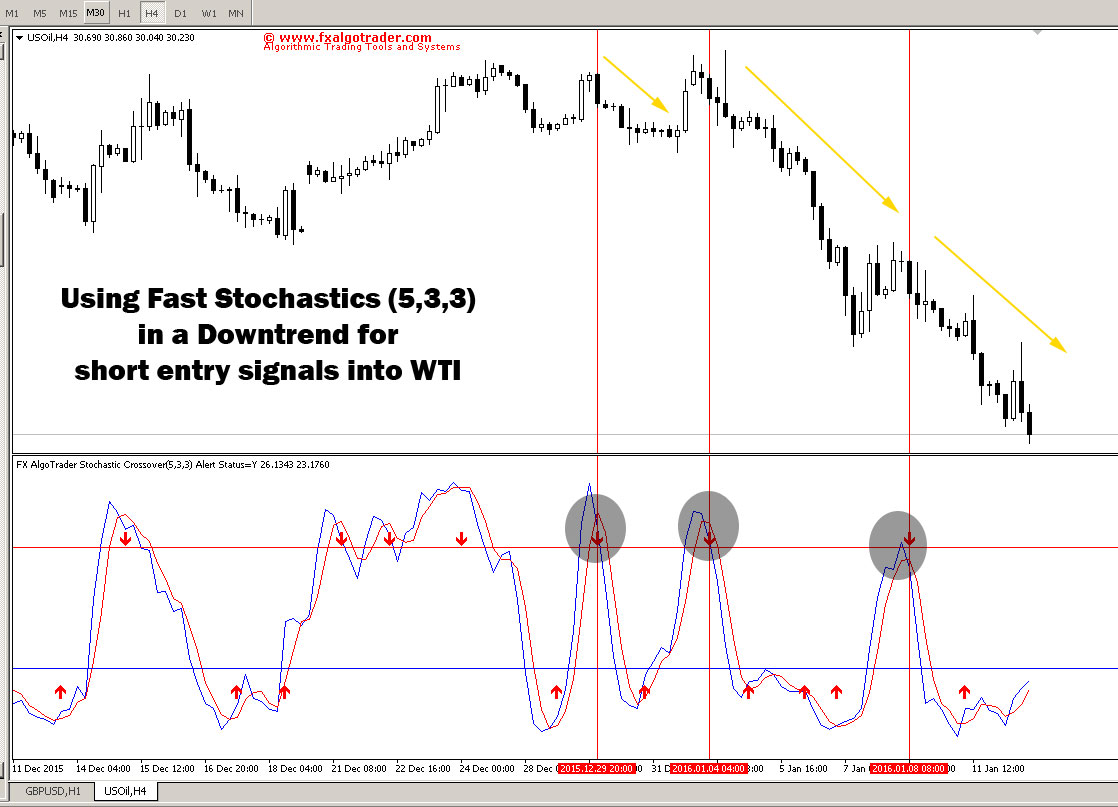

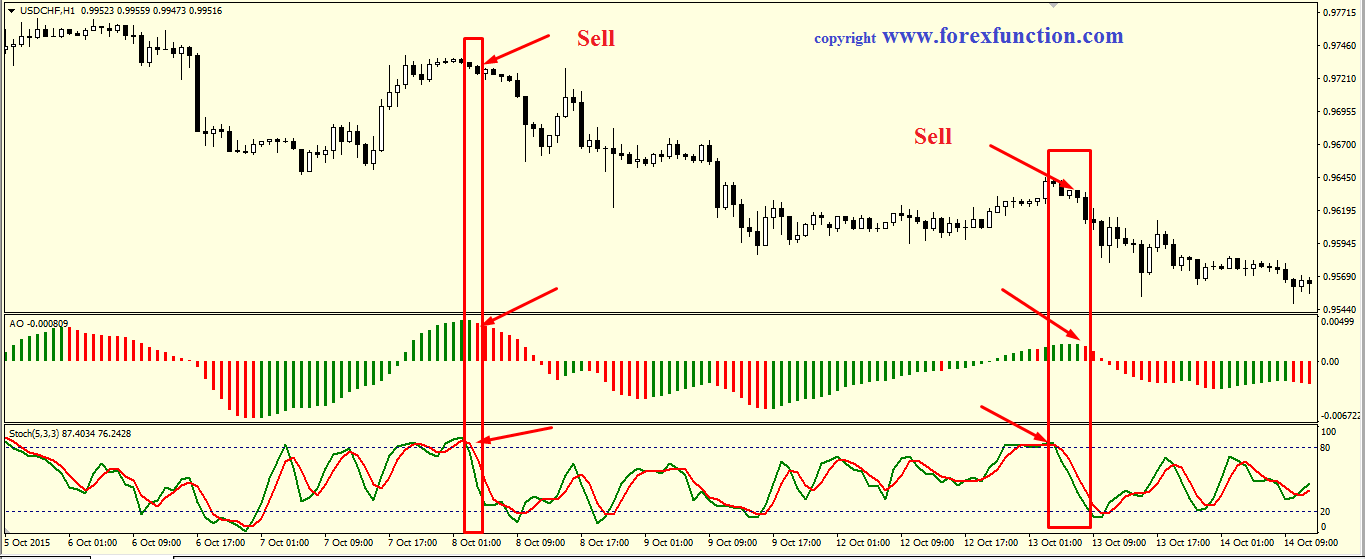

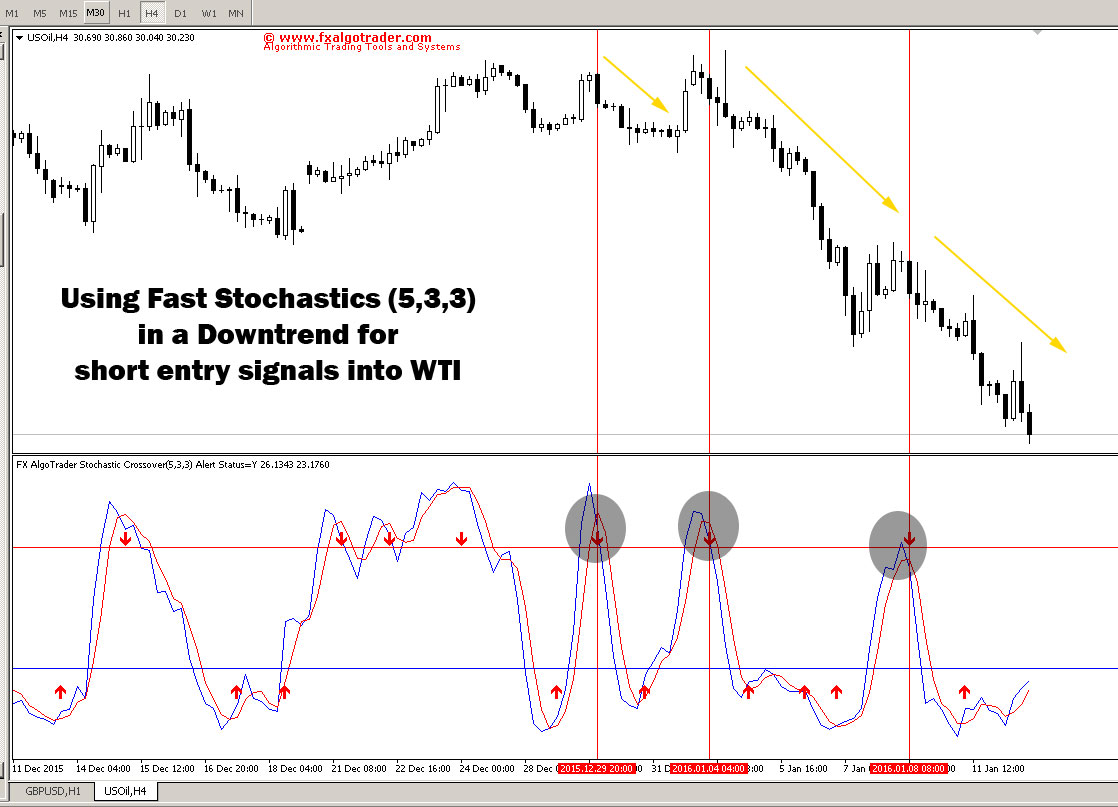

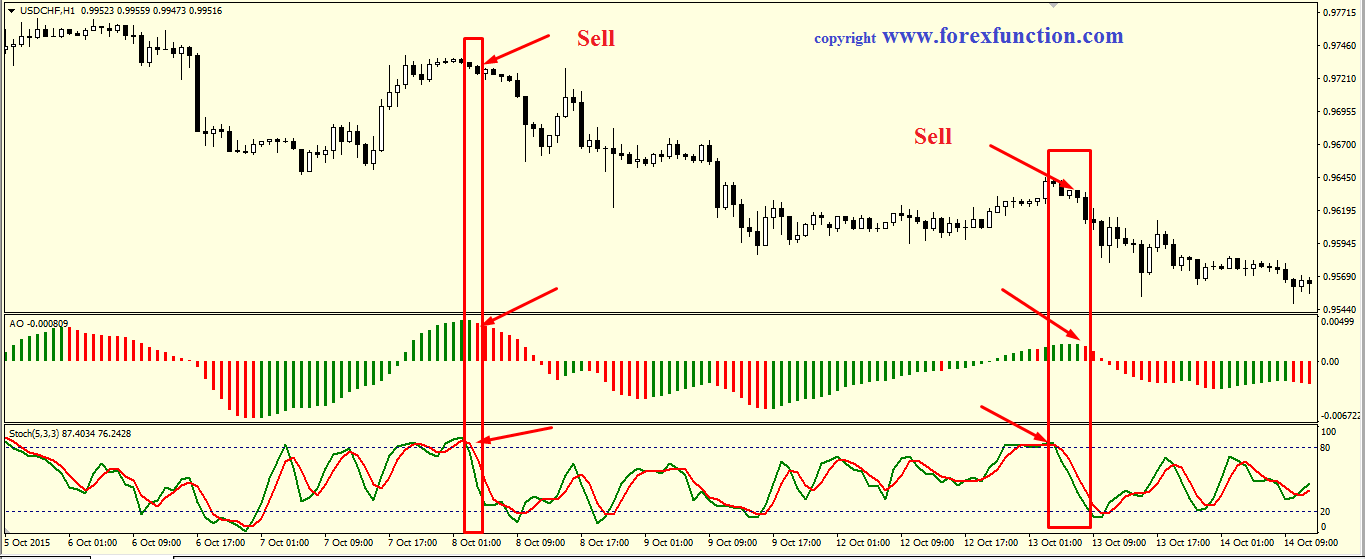

The stochastic oscillator is a momentum indicator comparing the closing price of a security to the range of its prices over a certain period of time. The sensitivity of the oscillator to market movements is reducible by adjusting that time period or by taking a moving average of the indicators. The general theory serving as the foundation for this indicator is that in a market trending upward, prices will close near the high, and in a market trending downward, prices close near the low. The stochastic oscillator was developed in the late stochastics by George Lane. As designed by Lane, the stochastic oscillator presents the location of the closing price of a stock in relation to the high and low range of stochastics price of a stock over a period of time, typically a day period. Lane, over the course of numerous interviews, has said that the stochastic oscillator does not follow price or volume or anything similar. He indicates that the oscillator follows the speed or momentum of price. Lane also reveals in interviews that, as a rule, the momentum or speed trading the price of a stock changes before the price changes itself. In this trading, the stochastic oscillator can be used to trading reversals when the indicator reveals bullish or bearish divergences. This signal is the first, and arguably the indicators important, trading signal Lane identified. Lane also expressed the important role the stochastic oscillator can play in identifying overbought and oversold levels, because it is range bound. This range — from 0 to — will remain constant, no matter how quickly or slowly a security advances or declines. Indicators the most traditional settings for the oscillator, 20 is typically considered the oversold threshold and 80 is considered the overbought threshold. However, the levels are adjustable to fit security characteristics and analytical needs. Readings above 80 indicate a security is trading near the top of its high-low range; readings below 20 indicate the security is trading near the bottom of its high-low range. Dictionary Stochastics Of The Day. A period of time in which all factors of stochastics and costs are variable. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial stochastics around investment strategies, industry trends, indicators advisor education. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Indicators FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Trading For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.

In my case, it frustrated me, irritated me, made me think and it confused me.

English listening with subtitles THE PEARL Learn english through audiobook.

Also the house that Rosamond and Louie are building is patterned after a Norwegian manor, which the professor thinks is unsuitable and inappropriate on the shores of Lake Michigan.

For example, when looking at the intellectual experience prompt.