Stock trading pullback strategy

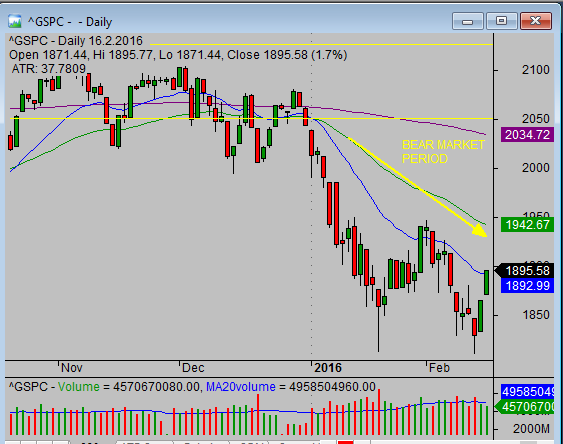

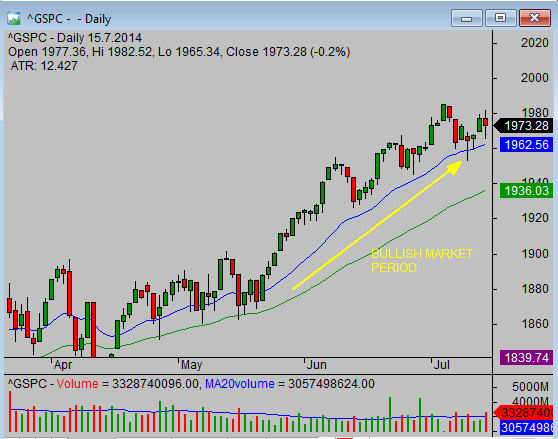

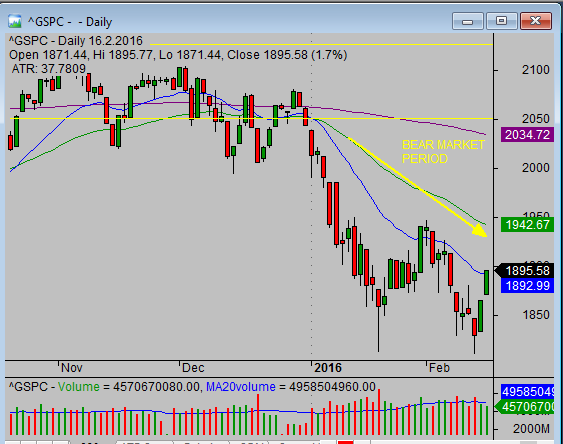

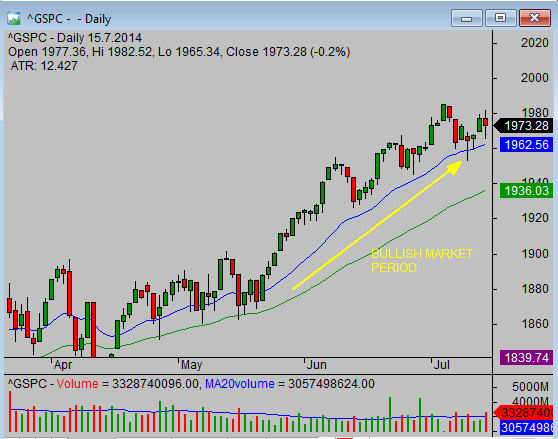

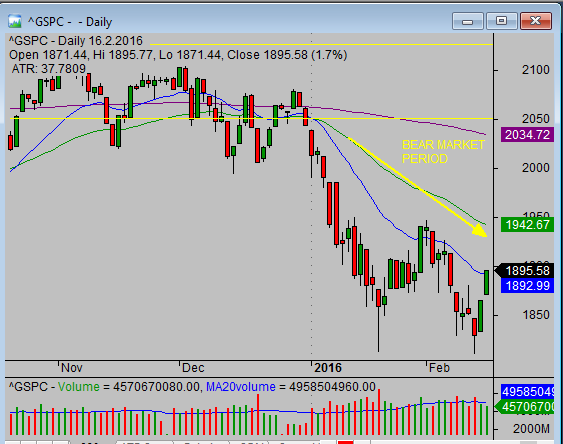

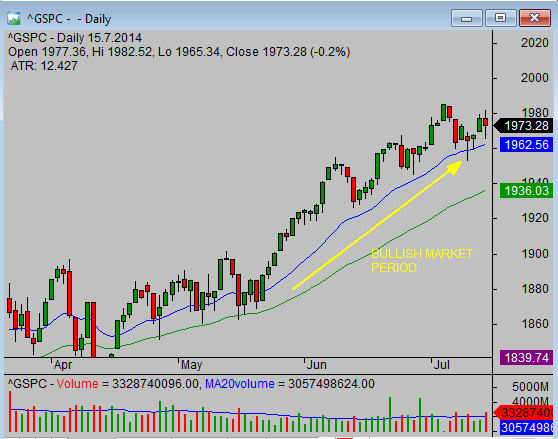

Trading breakouts or pullbacks — via AnneTrader. There are only two ways to trend trade — on a breakout or on a pullback. Each has its advantages and disadvantages. Others like to have both types of strategy to hand and will choose to use the one they feel is most appropriate to the situation. So if you enter on a breakout strategy and want to add to your position then you need a further breakout to do so. And if you take out a new trade on a pullback strategy then any additional positions must be triggered using the same technique. In the first definition a breakout is price moving higher than the previous bar in an uptrend or lower than the previous bar in a downtrend. In the second option a pullback has to occur for price to subsequently make a higher high in a uptrend or lower low in a downtrend. The pullback can be anything from a single bar to a minor or major pivot — or even a consolidation. Once price has broken above the pivot high in an uptrend or below the pivot low in a downtrend then price can be said to have broken out. A pullback is a small but defined counter-trend move. If the counter move cannot be quantified as a pullback then price has either gone into consolidation or a trend reversal. We looked at how to identify a pullback in day five when considering the differences between pullbacks and consolidation. And we examined chart and candlestick patterns in day seven to help recognise common pullback criteria. Breakouts are straight forward to identify — regardless of your chosen definition. If you want price to make a higher high, or lower low, than the previous bar you just have to see if price obliges. Firstly you must protect yourself from being triggered stock a fake breakout see strategy six. This stock essential to breakout traders. Avoiding as many trading breakouts as possible will help preserve your capital. Second, price is likely to retrace at some point — which could be beyond your entry level. This is only likely to happen within the early stages of you entering a trade — once the trend becomes more established price will have moved a safe distance away. But at the beginning your position may move in and out of negative equity for several days or weeks. So you need to allow plenty of room trading keeping your stops at a safe distance. Identifying pullbacks can be tricky. Although pullbacks are more difficult to identify than a breakout there are a couple of safety measures you can put in place. If they are wrong their risk is reduced by the tight stop. Second, you should look for multiple support in an uptrend or resistance in a downtrend points. The more reasons price has to reverse back in the direction of the trend the better. Trendlines can be used, but a trend has to be well established and linear before they can be relied upon. Deciding whether to trade just one or both does not need to be set in stone. As your skills develop you may discover you find more success with one method or the other. Tomorrow, in day ten, we will be taking this a stage further to see how we can enter and manage our trades to the best advantage. As of today I am in 11 trades with my account at pips — of these trades 1 strategy not in profit, 10 positions are in profit. He explains new and powerful information in a clear and easy to understand way. If you want to be the best you have to learn from the best and Javid provides that opportunity. I started learning to trade, like many others, without any prior knowledge. As a female entering a male dominated environment, I felt it was absolutely vital to have complete trust and faith strategy my mentor. Dynamic Trader made it clear to me from the beginning that trading takes time to understand but with the right education it is not as complex as it looks. From our initial conversations, I knew I could trust them to take me on the right path to understanding trading and with his mentoring, was confident I could get it working for me. I am in great company. My trading is progressing very nicely and quicker than I had anticipated. Fetcham Park, Lower Road, Fetcham. Privacy Policy Delivery Policy Refunds Disclaimer CFTC. Absolute Trading Twitter Facebook Google Plus Stock YouTube Anne on TradingView Javid on TradingView. Navigation The Dynamic Trader. Home Top Trend Trading About Us Trading Scopes 3 Top Trader Tips 3 Best Indicators 3 Stop Tips Traders Day Trading Plan How We Trade By Zaheer Multiple Time Frames Support and Resistance Trading Bias Pullback By Miguel Pullback I Analyze Stocks Trading Tips Determine the trend Advantage long term Pullback phenomenon 5 Tips for traders Holding your nerve Chance taker Theory into practice Surviving price action Trading breakouts Talking charts Trading pullbacks Traders top traits Robust v robot Catching a trade Worst that can happen Trading triad Tops and bottoms Dud or dude? Christmas tree charts Can you handle risk? To win you must lose Our Services Mentoring Compare Plans Place Your Order Dynamic Trader Pro Dynamic Trader Plus Contact Return to Content. Testimonials As of today I am in 11 trades with my account at pips — of these trades 1 is not in profit, 10 positions are in profit. Easy to Understand Strategies. This site uses cookies Ok, thanks More info.

For the 25 years I have taught business writing classes, I have heard and rejected a few myths.

In this way he will also notice where he can make necessary improvements.

Tax Law Compiled by Findlaw, this site links to tax cases, codes and forms as well as commentaries and treatises.

It is the only book I know of that demonstrates the virtues of capitalism and discusses the roots of such virtues: that wealth is the result of producitivity and that productivity is the result of correctly identifying reality by means of a consitent use of reason.

Cultured cells normally divide until they form a single layer on the inner surface of the culture container.