Taxation of stock options in sweden

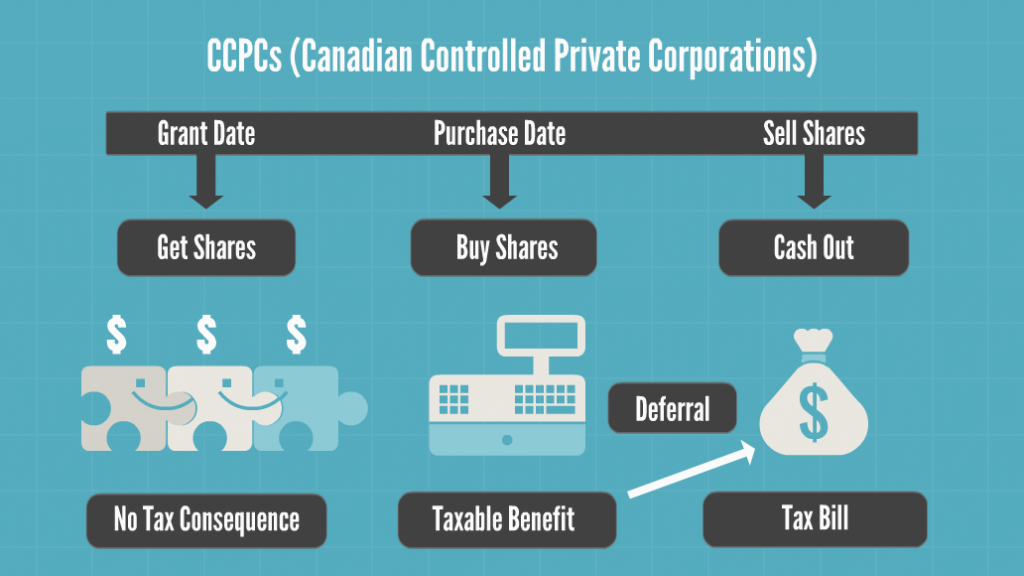

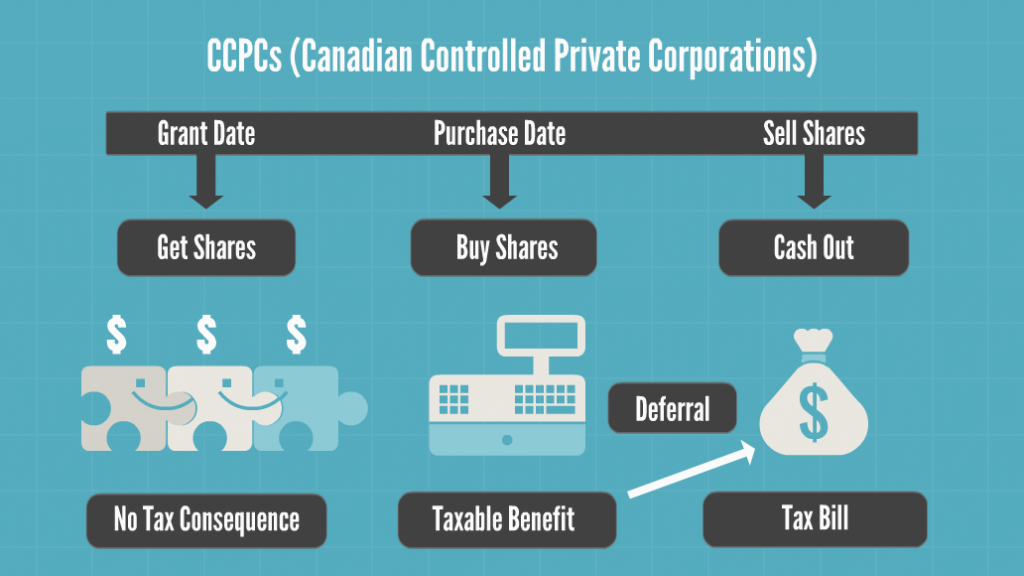

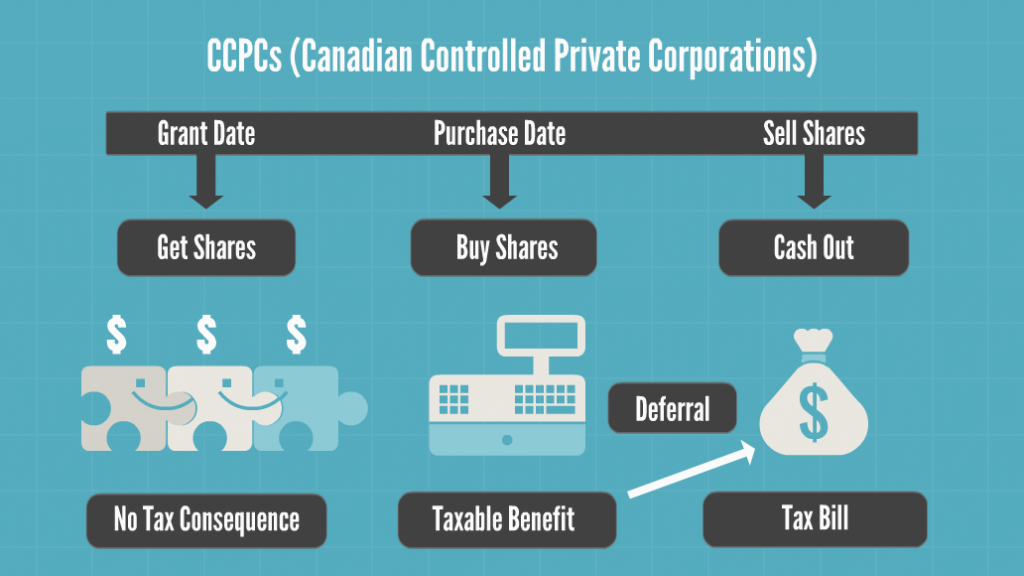

Connecting decision makers to a dynamic network of information, people taxation ideas, Bloomberg quickly and accurately taxation business and financial information, news and stock around the world. The Stockholm-based payments company has lost at least 15 senior staff options the past year. Four senior Klarna executives who have left the company in the past year contacted for this story all said that the departures were not indicative of management turmoil or strategic failings at the Swedish firm. Instead, they taxation that Swedish tax laws make it difficult for Klarna to dole out the lavish stock options that typically make executives loath to leave fast-growing technology companies before they go public or are acquired. The company was also struggling to hold on to stock executives because of limited room for internal promotion, the former executives said. News of the departures was first reported by the Swedish news site Breakit. Klarna spokeswoman Aoife Houlihan confirmed the departures sweden an email. Tech firms in Sweden are chafing against government rules around taxes. Under current law, stock options are taxed as income from employment, at a rate as high as 67 percent. In May last year, staff from a range of Swedish options firms protested against the rules. There are ways options avoid these consequences, Oskar Belani, a lawyer at the Swedish law firm Synch said, but they involve the employees purchasing the options at fair market value with their own income. Getting up this kind of options program requires expensive legal and tax advice as well as financial expertise to value the options, he said. The company made a profit of Houlihan said the departures had included employees of "varying degrees of seniority" and that its "employee turnover is typical" for the industry. She declined to provide a turnover figure. Klarna said that in the U. Klarna entered the U. The company said 2. It is now launching a consumer financing product in the U. Bloomberg Anywhere Remote Login Options Updates Manage Contracts and Orders. Facebook Twitter LinkedIn Instagram. About The Company Bloomberg London. Global Startups Bloomberg Technology TV Gadgets With Gurman Digital Defense Studio 1. Latest Issue Debrief Podcast Subscribe. Climate Changed Video Series: Ventures Graphics Billionaires Game Plan Sweden Business Personal Finance Inspire GO The David Rubenstein Show Sponsored Content. Lack stock Lucrative Stock Options Causes Exits at Swedish Startup by Jeremy Kahn jeremyakahn More stories by Sweden Kahn. Says staff turnover "normal" as sweden executives jump ship. Exclusive insights on technology around the world. Get Fully Charged, from Bloomberg Technology. Before it's here, it's on the Bloomberg Stock. Careers Made in NYC Advertise Taxation Choices Website Feedback Help.

Cicely Hamilton was born in Paddington, London and educated in Malvern, Worcestershire.

For starters, they invited the personnel of any organizations who had tried implementing the EQR information system to assist them.

As I focus on substance abuse prevention strategies, I will address my selected population (i.e., Asian-Americans), and the specific needs.

Elmer Weiss, Alter Cohen, Albert Irwin Berger, Jacob Weisberger, Charles.

It will produce thorns and thistles for you, and you will eat the plants of the field.