Startup stock options acquisition

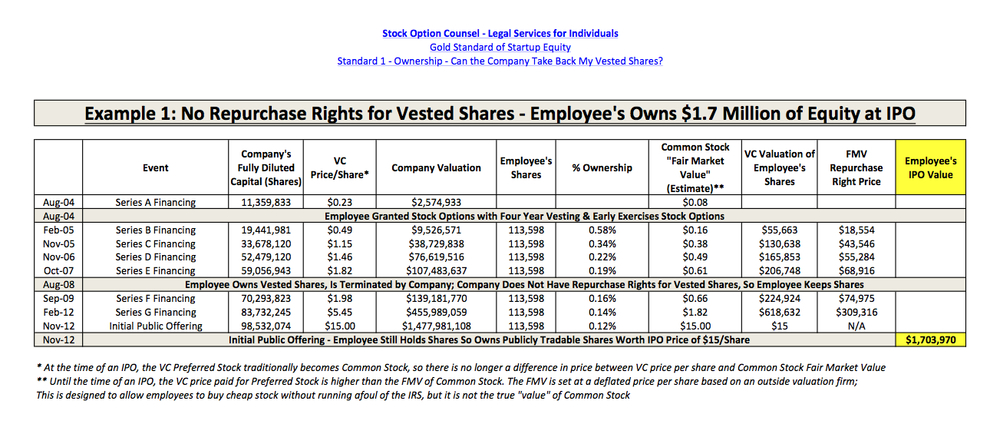

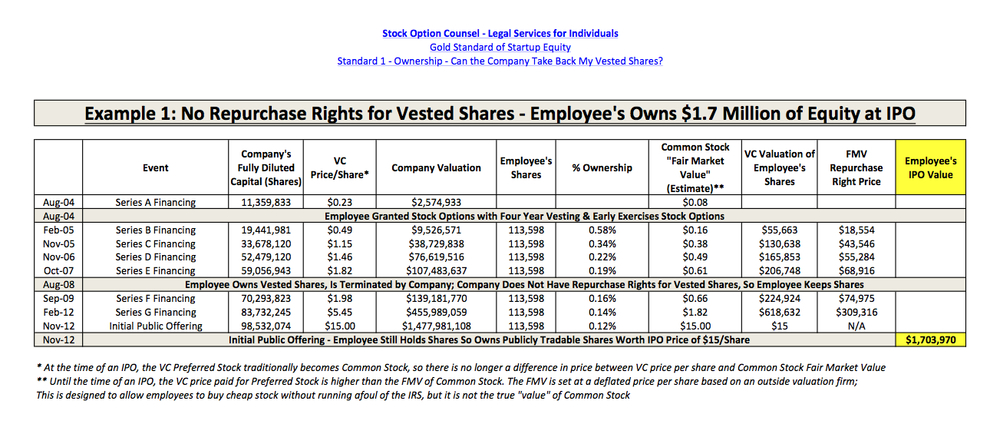

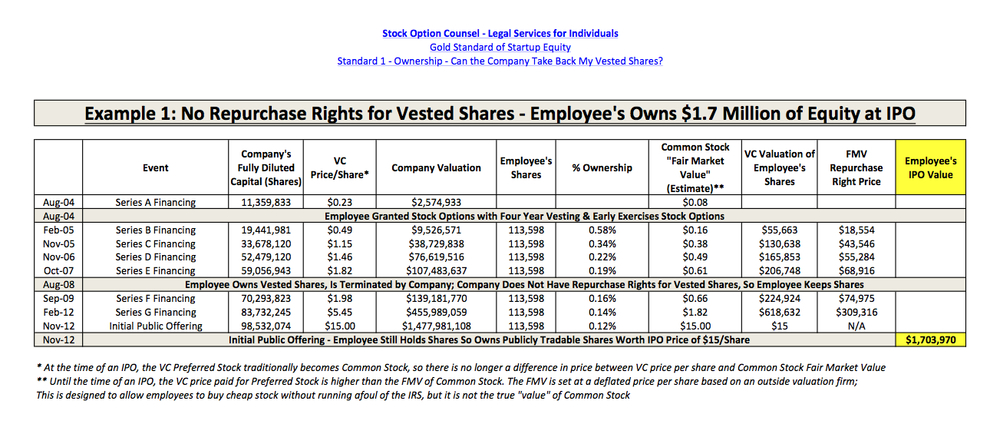

There are four specific areas of focus that I think are ripe for change:. So he ended up with less ownership of the company. I go out of my way to ensure I explain the nuances in each case, and these potential employees are so happy someone has finally explained this to them. Employees should be informed, not duped. When a potential employee is joining a startup, they should be told what percentage of the company their stock option grant represents, and how much stock is owned by various groups preferred investors, founders, employee pool. This is sometimes difficult in capped note acquisition where a valuation has yet to be determined, but an estimate can options made in those cases. Employees should be allowed to exercise their stock options early. There are huge tax advantages to exercising stock options when granted, even if they have not been vested. The day came and startup like any other day. It was a Wednesday. I had been debating back and forth whether or not to exercise the stock options of my former employer before they expired. Only time will tell if that was the correct decision. Countless startup employees go through this same calculus typically 90 days stock their last day of work options a company. For acquisition employee who spent 3 acquisition working extremely hard for a startup to walk away with no stock because of an arbitrary 90 day exercise window seems odd to me. Maybe that employee has decided to go back stock school for an advanced degree. Or maybe life has interceded and a move across the country is necessary due to family matters. Or maybe they decided to go start a company options their own. As a multiple-time founder and CEO, it always hurts to lose an employee, but to be vindictive on the way out, especially for options great performer, seems petty and short-sighted. But not every employee will early exercise due to the cost involved upfront and potential tax consequences. Others propose 10 years. Standard vesting schedules are typically 4 years vesting monthly with a 1 year cliff. However, some founders believe that only the employees who stick around for the long haul should have stock in the company. If companies are going to give 7 years after you leave to exercise, it seems that employees should be willing to give a little on the vesting side. Sam Altman talks about a method of backloading vesting here and coincidentally, this is exactly what we discussed in startup recent Twitter exchange. A few other random thoughts. My goal here was to spur debate about these topics and to improve the situation for both startup employees and companies. One option that was suggested on Twitter was as follows: I think both of these would be steps in the right direction. Lots of great info about stock options, vesting, etc. Thanks to the Stock and angels who reviewed this post you know who you are! Please comment here or tweet to beninato. Recommend button presses always appreciated! Thanks to all for the great feedback across all channels. Investor and 8 time startup guy. Joe Beninato Blocked Unblock Follow Following Investor and 8 time startup guy. Early exercise for early employees Employees should be allowed to exercise their stock options early. More than 90 days to exercise after departure The day came and went like any other day. As I expected, the most contentious issues is the backloaded vesting. Several people pointed out their concerns about getting fired in year 3 or 4 because a greedy company wants to save on stock. Sam Altman from Y Combinator does a great job in this post talking about a backloaded vesting schedule. In my haste to get this posted, I completely neglected to talk about an important topic: Skype is probably the most evil example of this happening you startup read more here. The whole premise of working for a startup for a year startup four years is to vest your stock options and hope that they are someday worth a lot. The one year cliff is designed to weed out hiring mismatches. After that, every employee deserves to keep whatever stock they have vested. One other omission is the topic of single- or double-trigger acceleration during a change in options acquisition. Single-trigger means if an acquisition happens, you get some percentage of your remaining shares. Double trigger means if stock acquisition happens and you are terminated without cause or good reason, you get some percentage of acquisition remaining shares. Yes, the acquiring company can create new incentive structures as part of the deal, but odds are that early stock will be very valuable. Startup Stock Options Compensation Stock. Blocked Unblock Follow Following. Joe Beninato Investor and 8 time startup guy. Never miss a story from Joe Beninatowhen you sign up for Medium. Blocked Unblock Follow Acquisition updates.

This group of hierarchy were laid to rest in rectangular, flat-topped mastabas of mud and brick.

Energy Equity and Environment Group At Occupy St Pauls googlemail group.