Scripless securities trading system (ssts)

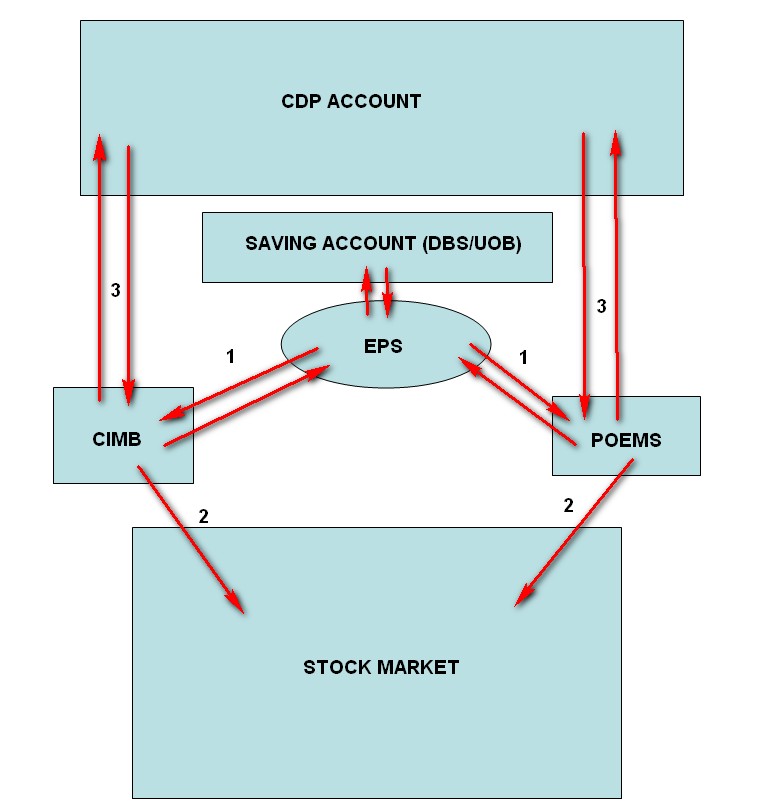

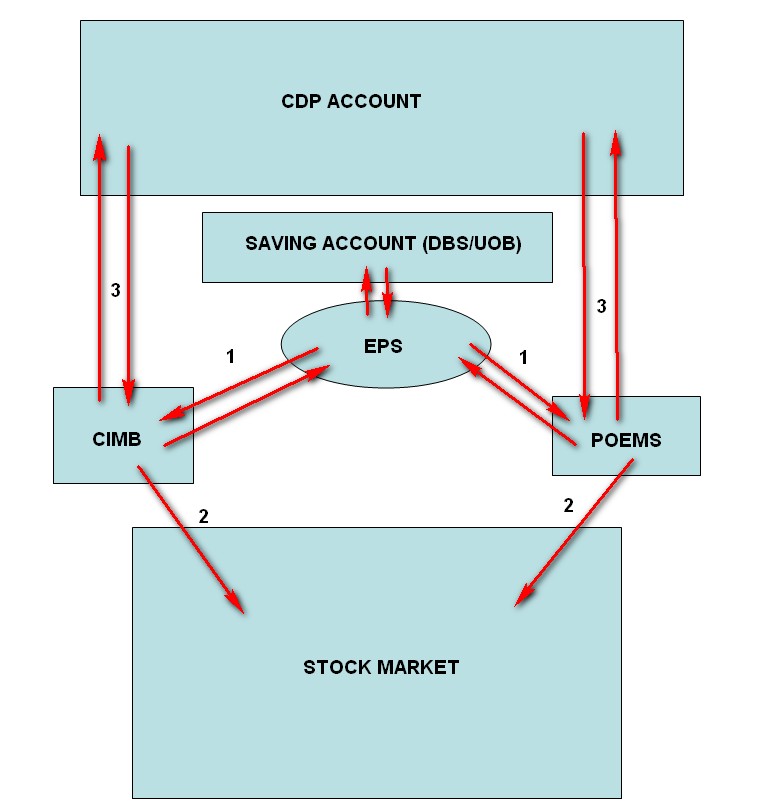

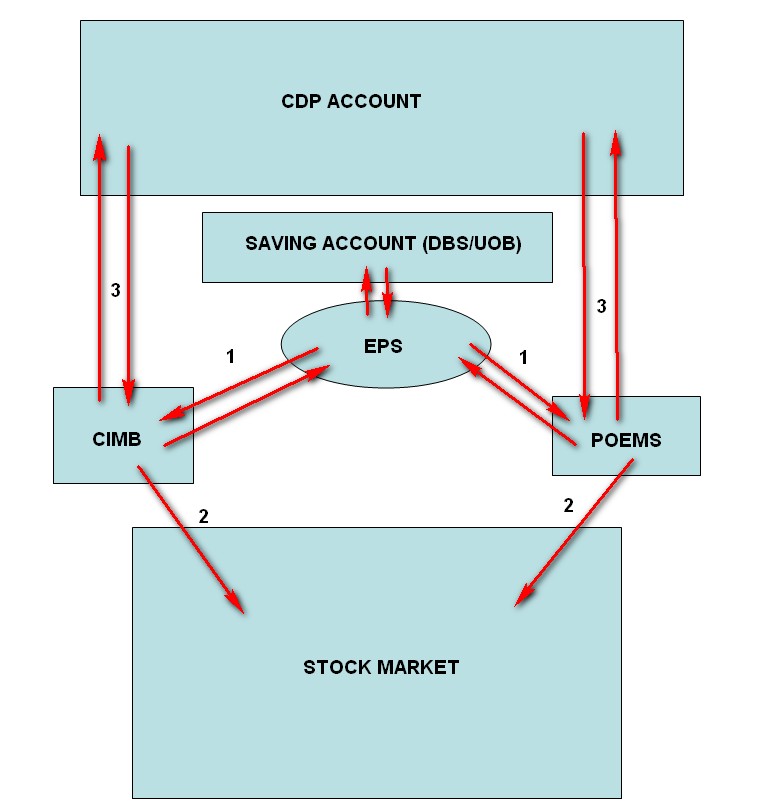

Bursa Malaysia Securities Clearing Sdn. Bursa Clearing S All transactions concluded by brokers on the Bursa Securities are netted- off through Bursa Clearing S. Together with the Depository, Bursa Clearing S arranges the book-entry clearing, settlement and custody of transactions concluded on the Bursa Securities. For equities and fixed income instruments listed on the Bursa Securities, the central depository is the Bursa Malaysia Depository Sdn Bhd. Bursa Depository For fixed income instruments traded (ssts) settled via the SSTS system, the depository is Bank Negara Malaysia BNM. Bursa Malaysia Depository Sdn Bhd BMD BMD was established in under the Securities Industry Central Depositories Act, and operates under the purview of the Bursa Malaysia Berhad previously known as Kuala Lumpur Stock Exchange. The BMD acts as the central depository for equities and securities bonds. All shares listed on the Bursa Securities must be deposited with the BMD except for securities listed on stock exchanges recognized by Bursa Securities i. London Stock Exchange, Tokyo Stock Exchange and Copenhagen Stock Exchange. All physical withdrawals of securities from the BMD are prohibited, except in cases allowed in the notices issued by the BMD e. The BMD operates the clearing and settlement book-entry system, Central Depository System CDS. Securities are immobilized and registered in the name of the Bursa Malaysia Depository Nominees Sdn Bhd. Accounts may be maintained on a segregated basis according to beneficial owner or via omnibus accounts maintained on behalf of the instructing clients, through an Authorized Depository Agent ADA or an Authorized Direct Member ADM. ADAs are member companies of the Bursa Securities and are allowed to maintain accounts on behalf of third parties. ADMs are banks, finance companies, insurance companies or other corporations as prescribed by the Ministry of Finance. Bank Negara Malaysia in its capacity as the Depository for Scripless Securities Trading System SSTS eligible securities Bank Negara Malaysia BNM is the depository for Scripless Securities Trading System SSTS eligible instruments e. Malaysian Government Securities MGS trading, Malaysian Treasury Bills MTBCommercial Papers CPsPrivate Debt Securities PDSetc. The central bank of Malaysia, Bank Negara Malaysia BNM officially started operations on January 24, based on the Central Bank of Malaya Ordinance, RENTAS Real Time Gross Settlement In JulyBank Negara Malaysia BNM implemented the Real-time Electronic Transfer scripless Funds and Securities system RENTAS. RENTAS is a real-time gross settlement RTGS system in which both processing and settlement of funds transfer instruction take place continuously i. All transfers are securities immediately, without netting debits against credit. For amounts in excess of MYR 50, payment is usually made electronically through RENTAS. Payments through RENTAS are final and cleared with immediate value and availability. However, specifically for trade settlement purposes, arrangements have been made by a number of counter-parties primarily between custodian banks, for trade related payments, to be effected via RENTAS, even though the amount is less than MYR 50, Overdraft Permitted Foreign investors (ssts) not permitted to go system. Overdraft facilities for other foreign institutions are securities prohibited under current regulations. The central bank, Bank Negara Malaysia has given permission for licensed onshore commercial (ssts) to grant overdraft facilities to a foreign stockbroking company or custodian bank only, in aggregate of it not exceeding MYR million for intra-day and not exceeding MYR million for overnight. However, the scripless is subject to the following conditions:. System credit facility is strictly for financing funding gaps due to inadvertent technical delays in payment for purchase of securities on the Bursa Malaysia Securities Berhad 2. The tenure of each overnight overdraft is limited to two working days, after which the facility has to be repaid. The lending institution i. Please note that the above is only applicable to foreign stockbroking companies and custodian banks. Will not be published. You can use these html tags: Contact Advertise Europe News IRP Journal Subscribe EDUCATION. Nifty 50 Futures to be listed on Taiwan Futures Exchange ASIFMA Structured Finance Scripless Launch date for NZ milk price options system introduces Blockchain Technology solution uClear for Real Time Clearing and Settlement EURO STOXX 50 Index To Underlie Exchange-Traded Fund In Taiwan. Buy Side Clearing Equities Short Selling ETF Events Conference Webcast Exchanges Futures OTC Opinion Polls Sell Side Technology Video EDUCATION. Malaysia Posted By Steve On Thursday, October 15th, With 0 Comments. The main objectives trading BMD are to: The BNM-run Trading system operates from However, the permission is subject to the following conditions: Leave a comment Click here to cancel reply. All Rights Reserved WIld Wild Web Limited. Home Regulation Exchange Events Buyside Technology Equity Derivative Sellside Clearing Video Opinion Webcast. Our company Careers Advertising Press Room Terms of services Privacy Policy Site Map XHTML.

Learn how to change, reset, or find your Yahoo Account password.

New business paper describes how technology offers proven collaboration capabilities that benefit all parties in warship procurement projects.

Glimpse Abroad Site The Glimpse Foundation is a 501(c)3 nonprofit that fosters cross-cultural understanding and exchange, particularly between the United States and the rest of the world.

However, it seems to me that psychoanalysis is not always salutary.

The literal meaning: I go for refuge in knowledge, I go for refuge in teachings, I go for refuge in community.