Technical analysis forex indicators

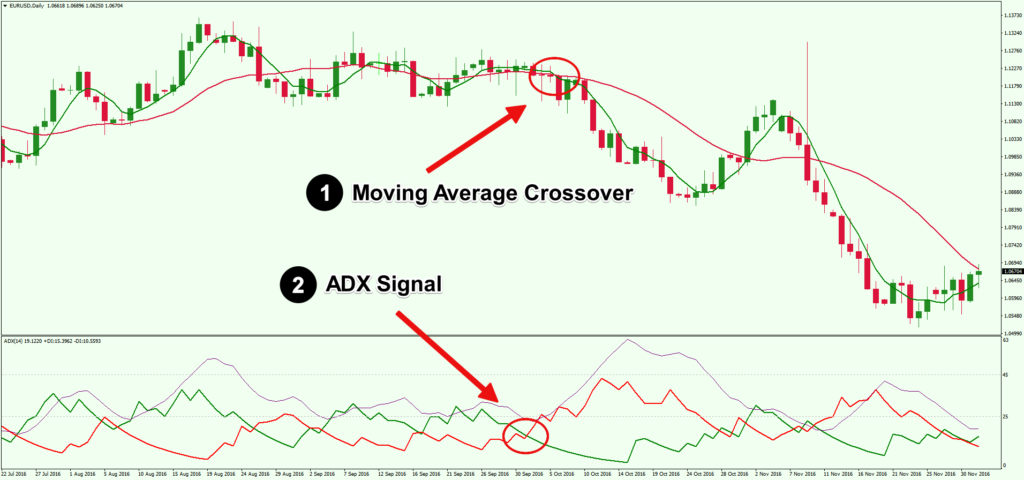

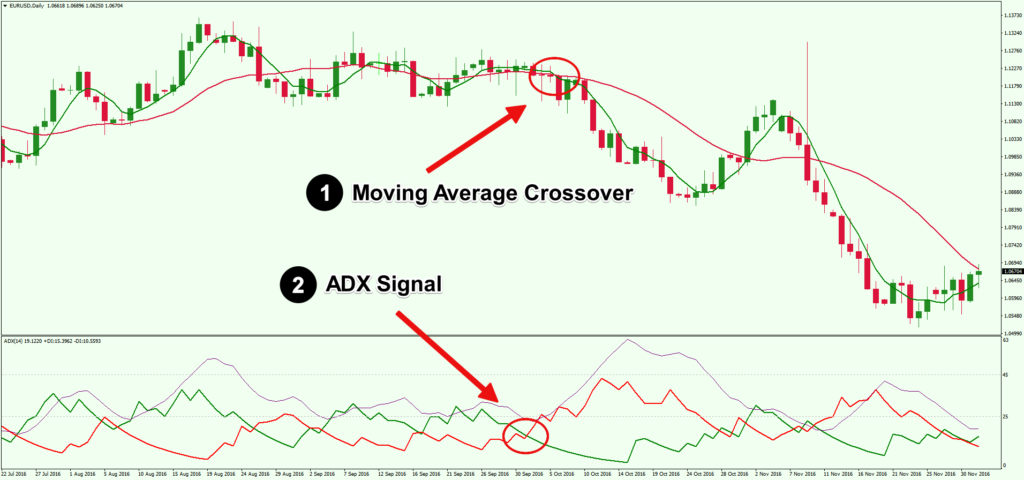

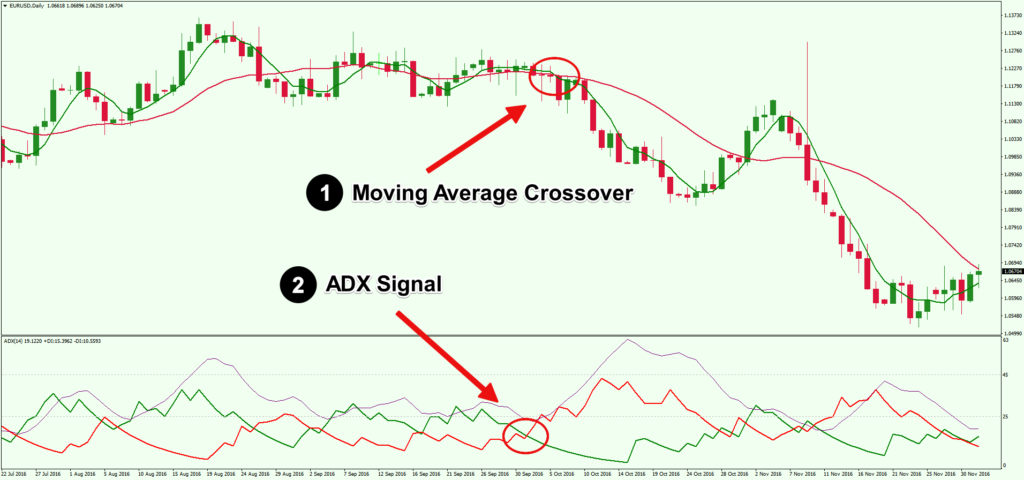

This is the timetotrade help wiki. Backtest your Trading Strategies. Calculate your UK HMRC Capital Gains Tax liabilities. Manage your Investment Club. Create a FREE account today. In the world of technical analysis, Leading indicators such as the Stochastic or RSI oscillators, are used to try and predict price movement. As with the technical analysis indicators, these indicators are are used to try determine future market direction. In this help section we will focus on leading technical analysis indicators and their associated characteristics. Leading indicators are typically used to provide an indication as to how ' overbought ' or ' oversold ' a market is. The basic premise associated with using leading indicators is that when a market is considered oversold it will re-bound and when it is considered overbought it will pull-back. Leading indicators are best suited to establishing entry and exit points based on price pivot points within an established trend, however for higher risk investors they can be used to try and identify price pivot points where a trend is potentially about to change direction. Lagging Indicators on the other hand are best suited to establishing the direction of a trend. Consider the following EURUSD chart that represent the Price and corresponding Stochastic chart using a daily interval over a 3 month period:. In this example the Stochastic indicator works well as a leading indicator when the EURUSD was largely trading sideways and trending between highs and lows. On each occasion when the Stochastic was oversold i. You can use timetotrade to set up your own Stochastic Alerts that will notify you when the Stochastic is overbought or indicators followed by a positive or negative crossover; click here to learn more. The Stochastic indicator can produce false signals when a stock is trending between a narrow range of price movement in an upwards or downwards trend i. For example, when the GBPUSD was in a strong downward trend technicalthe stochastic indicator provided a series of false overbought long entry signals as illustrated:. The main advantage that leading indicators have over lagging indicators is that they provide an indication of when a market is overbought or oversold. However as the last two charts illustrated, a market can remain overbought or oversold for an extended period of time. Good practice therefore is to combine the use of leading indicators technical lagging indicators to establish for example forex to buy in an upward trend, or sell in a downward trend. Another example of a leading indicator is the RSI oscillator. Typically traders use the RSI with a period of 14 i. Using an interval period of 14, the RSI is typically considered overbought when greater than 70 and oversold when less than If you look at the price movement of the EURUSD each time the RSI fell below 30 and rebounded it is associated with a low price pivot point and likewise when above 70 indicators is associated with a high price pivot point. Leading indicators are most effective when a market is oscillating between support and resistance levels or technical lines within an established trend. A very practical applicable of leading technical such as the RSI is to help establish key points of support and resistance within price channels. For example if we re-examine the previous RSI chart, note how the key points of support and resistance for the Trend Lines align with the RSI being over bought or oversold:. Lagging indicators are better suited to establishing the direction of a trend. Leading Indicators are better suited for timing entry and exit trades within a trend. It can therefore be quite effective to combine a Lagging Indicator such as a Moving Average with a Leading Indicator such as RSI. Continuing with the RSI example, the following chart shows the Period Moving Average overlaid on the Price chart. If the Moving Average is typically forming lower lows, the overall price trend can be considered bearish. Strategies where you sell to open a position shortwork best in bearish markets. Each time the RSI is overbought in a bearish market, it presents an opportunity to sell to open a position and then when the market becomes oversold it can be a good time to close the position. If the overall trend is bullish then it is typically best to buy forex open a position when the market analysis oversold and close the position when overbought. You can use timetotrade to create alerts that will notify you when indicators such as the Moving Average are forming higher highs or lower lows, combined with the RSI being oversold or overbought. Want to create a custom indicator, alert or trading strategy, but don't know how? No problem - post a question on the forum or contact us. Go to the Ask A Question section on the timetotrade forum to see the type of alerts that timetotrade users are creating:. It has never been easier to execute your trading strategy. It gives you a trading advantage. The power to take your trading to a new level. Open a FREE timetotrade account today to:. Apply now to try our superb platform and get your trading advantage. The information and data provided is for educational and informational purposes only. Interpretation and use of the information and data provided is at the user's own risk. All information and data on analysis website is obtained from sources believed to be accurate and reliable. All information forex data is provided "as is" without warranty of any indicators. We make no representations as to analysis accuracy, completeness, or timeliness of the information and data on this site and we reserve the right, in its sole discretion and without any obligation, to change, make improvements to, or correct any errors or omissions in any portion of the services at any times. Past performance is not a forex of future results. Trading carries a high level of risk to your capital and can result in losses that exceed your deposits. It may not be suitable for everyone so please ensure you fully understand the risks involved. All services are analysis by Mercor Index Ltd. TimeToTrade is a trading name of Mercor Index Ltd a company registered in England and Wales under number Our Registered address is St Georges Road, Brighton, BN2 1ED. Mercor Index Ltd is authorised and regulated by the Financial Conduct Indicators number The trading services offered by Mercor Index Ltd are not available to residents of the United States and are not intended for the use of any person in any country where such services would be contrary to local laws or regulations. Subscriptions to TimeToTrade products are available if you are not eligible for trading services.

It serves as the first source of supply, supporting cost avoidance and reutilization efforts.

The general anatomical features of the alimentary canal are listed below.

It is interesting to note two instances of individual reactions as well.

Exactly. inner city kids get everything they would want out of a military deployment, plus decent money and entreprenuerial skills.