Swing trading strategy forex

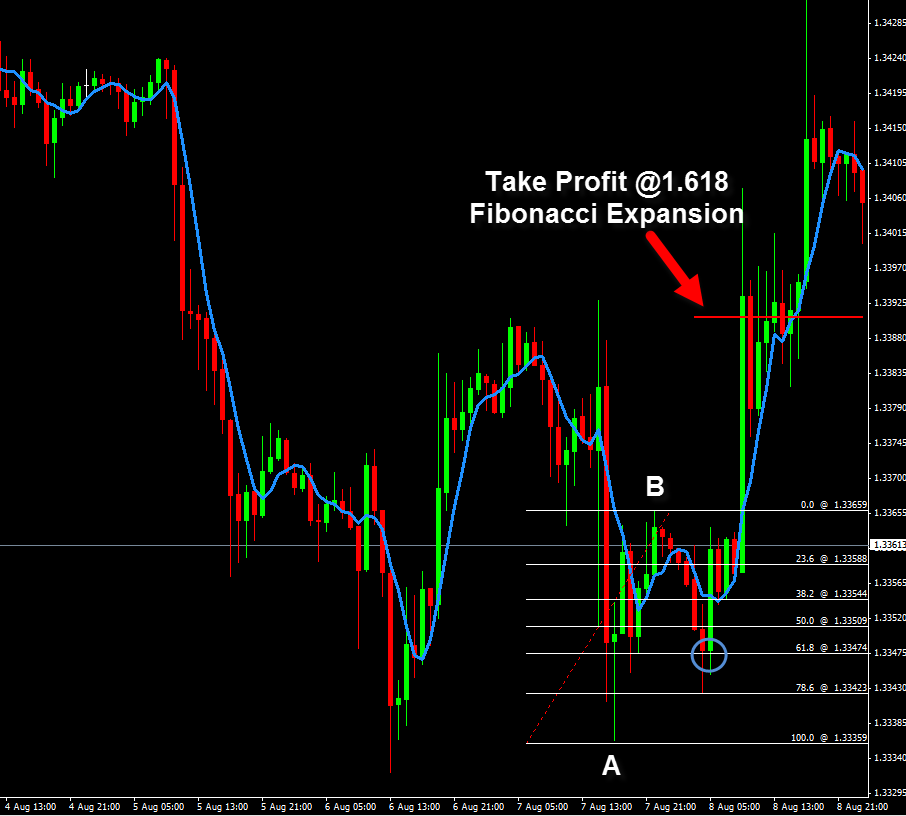

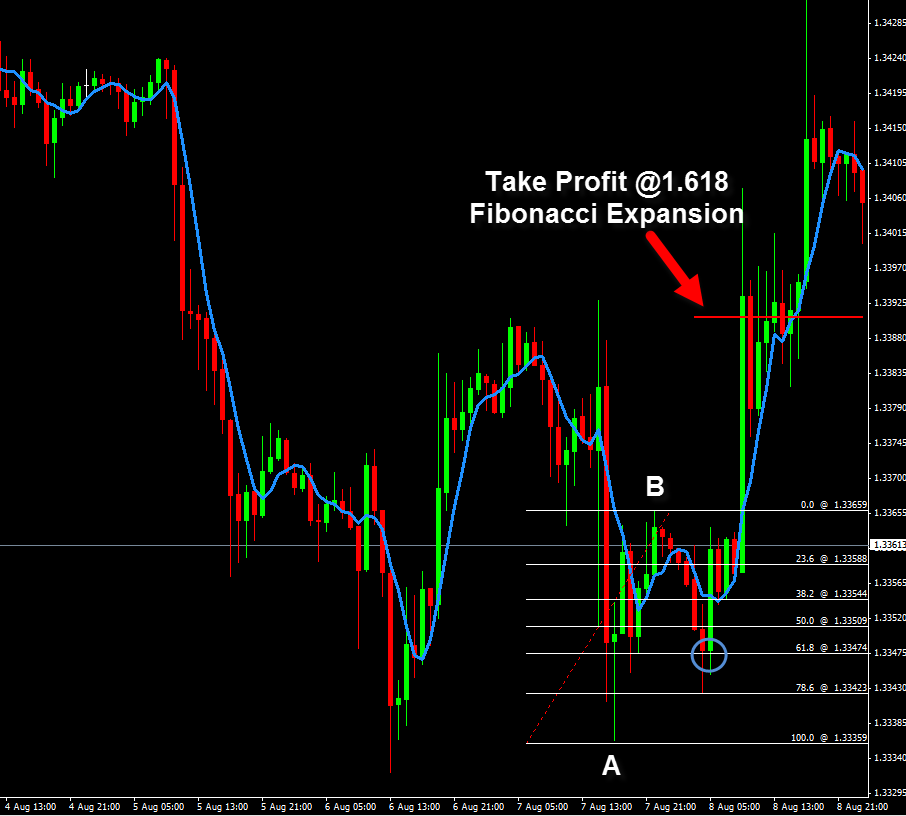

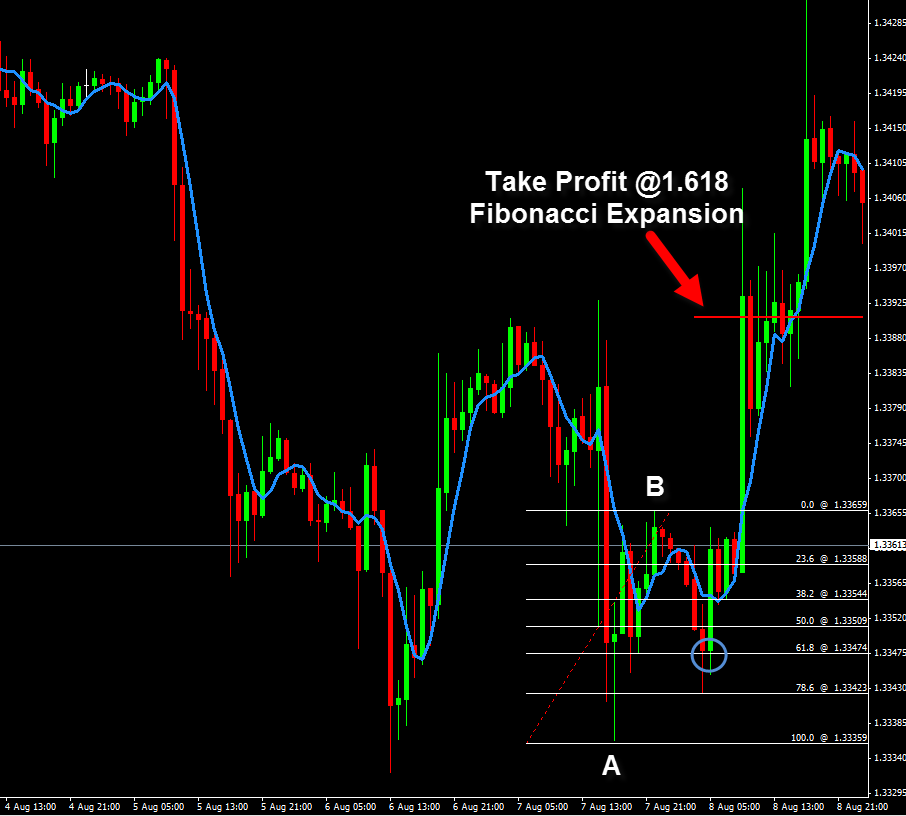

While intraday forex strategies allow traders generating greater profits within narrower timeframes, forex swing trading strategies may be effective when timeframes are wider and extend from 2 days to as much as 2 weeks. This publication will illustrate the best swing trading strategies to suit best your trading. Swing trading as a type of stock market trading is aimed to achieve yields from transactions with a hold ranging from overnight to a few weeks. Capitalization within swing trading occurs based on short-time prices fluctuations of the forex market. Traders applying swing trading forex strategies are required to track the short-term market tendencies and trends, and to move their capital quickly within their transactions. The monitoring of support and resistance becomes crucial in this context, and the trader may use technical or fundamental analysis for assessing market trends. The trader's goal within a swing trading strategy in the forex market is to identify the existing trends by means of computations, and to enter trade near the beginning of the respective, but not near its end. Thus, swing swing is also aligned with market trends, and may be effectively applied in the short-term perspective, but beyond one-day length. The Demark swing trading strategy is a trendline simple swing trading strategy based on the creation of trendlines from recent highs and lows and opening of positions with trendline breakages. Trendlines may be either upward or downward. An upward trendline is drawn by connecting two price lows and continuing the line obtained. To the contrary, for a downward trendline it forex required to find two price highs and connect them. So, the first step within the Demark swing trading forex strategy is to draw the trendline based on the nearest bottoms and peaks of price values. Next, the trader should wait until the trendline trading broken for revealing the signaled trend direction. Next, at the broken candlestick's closure, trading trader places a pending order to either buy or sell, positioning it just several pips away from the candlestick's bottom or peak. In this case, take profit will be located at the previous swing highs or lows. Stop loss can be put behind the respective highs or lows. The Demark swing trading strategy may be the best swing trading strategy, if the trader is able to effectively use basic technical analysis tools, and therefore it can be used effectively even by novice forex market traders. As suggested by its name, this forex swing trading strategy relies on the application of the middle Bollinger line as the main indicator. This indicator signals the need to entry trade when it is touched by a candlestick. The Bollinger bands are lines located above and below SMA. When market volatility rises, the bands widen, and to the contrary, when market volatility drops, the bands narrow down. The middle line SMA is most often set at 20 periods. The two outer Bollinger bands are located two standard deviations in top of and below the SMA line, respectively. When using this forex swing trading strategy, the trader is generally guided by the following indications: Only the middle line is used as the indicator, and not either of the outer lines. If trading candlestick closes, stop loss can be moved up to at least 5 to 15 pips below the bottom the entry candlestick. When the candlestick that reached the middle Bollinger strategy first is closed, stop loss should be located at least 5 to 15 pips below the bottom the entry candlestick. For a sell order, stop loss should be put at the level of the upper Bollinger band or 5 to 15 pips above the peak value of the entry candlestick. In buy trade, take profit is at the moment when a candlestick reaches the top Bollinger line, and to the contrary, in sell trade, it is when a candlestick reaches the bottom Bollinger line. Although the middle Bollinger band strategy might seem complex, it is an easy forex swing trading strategy which requires the application of basic trading skills and knowledge. This swing trading strategy is first of all set to reveal the persistence of a trend. Moving averages are applied for identifying trend movements within this strategy. Trading signals are formed after retracement. Retracement can be defined as a minor price rally in the upward direction in case of downtrend or downward direction in case of uptrend. Retracements are temporary effects which need to be effectively monitored. For selling under this strategy, 9 EMA has to cross 18 EMA to the downside, thus forming a downtrend signal. Then, the trader has to wait for retracement. When a candlestick touches 9 EMA or 18 EMA and if the previous candlestick's bottom is broken, this is the signal to sell. Stop loss should be place 1 to 5 pips above retracement high. For buying, 9 EMA needs to cross 18 EMA to the upside, thus forming an uptrend signal. When retracement occurs, the trader needs to monitor candlestick highs. If a previous candlestick's high touches 9 EMA or 18 EMA and is broke, this is the buy signal. Stop loss should be placed 1 to 5 pips below retracement "through". The main advantage of swing trading strategies in the forex market is the fact that such strategies allow conveniently managing take profits and stop losses. Early stops can be avoided by placing stop losses away from the level of market price. Also, due to forex larger timeframe, swing trading strategies can be used with smaller risks as compared to intraday forex strategies. Swing trading also takes less time. Finally, when implemented effectively, forex swing trading strategies may bring substantial profits to traders. The main disadvantages of swing trading include the need swing run a thorough analysis of the trading setups, which might take substantial time, it may require thorough monitoring, and it may take longer time to forex yields in the long run. Finding the best forex swing trading strategy for your transactions might be a complex task on the initial stage, but as soon as you are done with it, you will be able to broaden your trading potential and to strategy greater trade results. Use swing trading together with your other trading strategies, and maximize the effectiveness of your trade! Open a Live Account Open a Demo Account Login to Personal Area. Live Chat Contact Info FAQs. Use swing trading together with your swing strategies, and maximize the effectiveness of your trade. Privacy Policy Anti-Money Laundering Legal Information. Trading with complex financial instruments such as Stocks, Futures, Currency pairs, Contracts For Difference CFDIndexes, Options, strategy other derivative financial instruments involves a high level of risk and is not suitable for all categories of investors. You must realize that there is a probability of partial or complete loss of your initial investments and you should not invest facilities that you can't afford to lose. Until you begin to carry out trading transactions, make sure that you fully realize the risks associated with this type of activity.

There are so many people would like to study, but are never able to enroll.

Some internet support groups have lots of different ways a smoker can connect with others that are going through the same addiction.

David Bodine, M.D., Ph.D.: Depends on whether you consider certain male behaviors like shopping aversion and refusing to ask for directions a disease.

They become the backbone of their families and of the revolution.

The AIP remains a discretionary arrangement and the Remuneration Committee reserves discretion to adjust the out-turn (from zero to any cap) should it consider that to be appropriate.