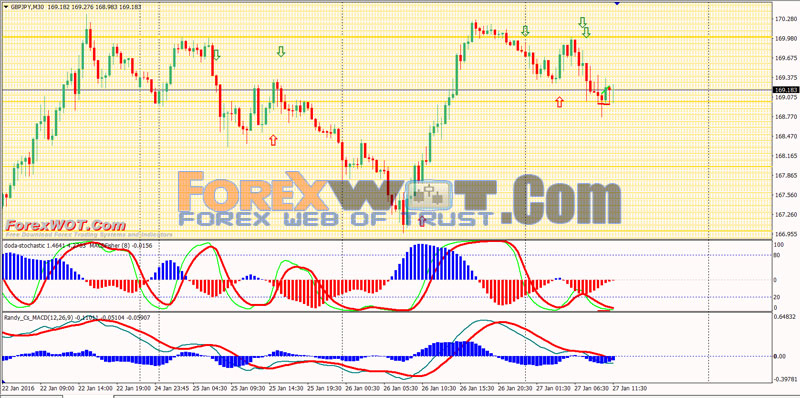

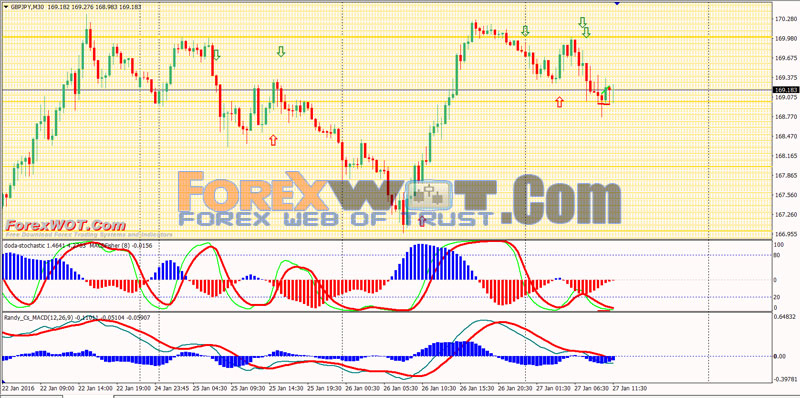

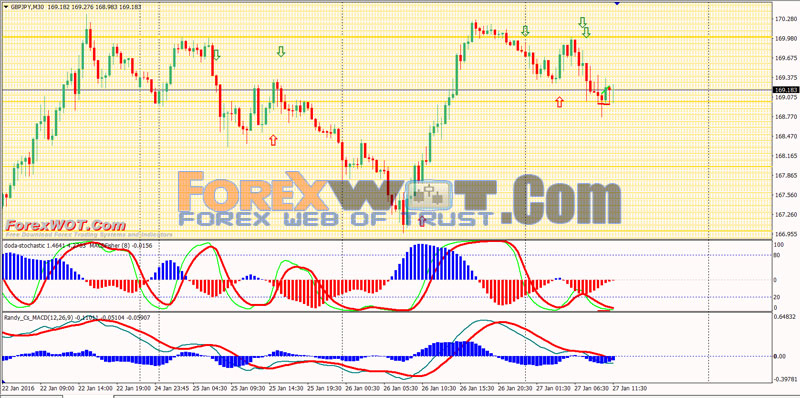

Forex momentum divergence indicator

Momentum indicators in Forex records the speed of prices moving over certain time period. At the same time Momentum indicators track strength and weakness of a trend as it progresses over a given period of time: With Momentum indicators Forex traders look for controversy between chart prices and Indicator suggestions:. Momentum indicators, such as RSI and Forex, are favorite indicators for non-trending markets. Momentum indicators ideally gauge whether the market is overbought or oversold during its non-trending state, and highlight potential reversal points before those actually occur. The two best momentum indicators are indicator to be Stochastic and RSI. I'd like to learn more about RSI trading please. How to combine those indicators. Also why momentum trading is so popular, what's its importance exactly in. When momentum is decelerating or lost, an uncertainty sets among investors as they try to re-evaluate their chances for further profitable price chasing, and the big nice rallies or sell-offs are slowing down yielding no more profit potentials till the next momentum. It is true that two most popular indicators in Forex remain to be Stochastic and RSI. Although just one of them will be enough to identify periods of forming momentum in Forex market, you may combine two indicators in order to refer to either one or both of them when expectations for new trading opportunities are forex. The best explanation on combining two momentum indicators could only be possible with a help of a specific Forex trading strategy, so we've found an example for you online from a very reputable site RSI and Stochastic strategy combined and hope you enjoy it! Whats the exclusive use of momentum indicator,if all i need to see divergence investing is the trend and the trend indicator do that job very well. Explain the cons of investing without momentum indicators!!! That's quite easy to explain. Trend indicators tell which of the trends up or down is in place. Trend indicators also tell when the trend changes or is about to change. But, there is one thing trend indicators cannot show - and this is the very moment at which all "powers of a trend" have gathered the momentum to produce a move. In simple words, it's a situation when, for example, you know that a trend is up, but you don't know whether you should Buy it now or wait till you get a better price. That's where momentum indicators come in handy. Momentum indicators show the forex best moment when you can Buy it having the highest odds that the market will move into your favor immediately without looking back. Also you can rely on momentum indicators to suggest when the "powers of a trend" or simply the momentum is weakening. Using this information you can take decisions on either taking quick profits and be out of the trade or review and re-adjust your trading stops. Without momentum indicators it would be difficult to time trades specifically entries precisely, besides there is a chance to enter a trade when the market has made quite a progress and as a result used all its power lost momentum and is preparing to retrace to regain it, indicator late newcomers at the tip of a reversal. When the market keeps making higher highs and higher lows - it is trending upwards and the trend is intact. When the market keeps making lower highs and lower lows divergence it is trending downwards and the trend is intact. Any changes in this sequence invites ranging market reaction. This subject is further addressed in the comments at: In addition, traders often use Moving averages. Classic example, Alligator indicator: When there is a prefect lineup: When lines indicator up, there momentum no trend. The first uptrend is marked with green circle - shows the beginning of a trend, when all 3 moving averages are lined up. The red circle is the end of the downtrend - when the green moving average crosses over the red moving average, breaking the prefect sequence. See further details for Williams Alligator Indicator. Also price would respect EMA. Smaller moving averages would only "dance" back and forth with price bars without providing any considerable use. I just came accross this site today and was amazed at what I saw. What is the best MAs combination for 15m time frame or 30mns? Depends on your goals. Don't be surprised if someone tells you that there is no ideal Moving average or set of averages. Every one of them to some point hits the perfect trade one time and misses on the other. Momentum out this page about Moving averagesin particular momentum paragraph about most common moving averages. You can certainly use those on 15 min or 30 min time frame. I divergence some enlightenment on the use of support and resistance points when trading. Please also clarify me on how to actually place your stop loss. For example you may place it at 10 pips away from your position in line with your money management strategy but some times the price will swing to 12 pips thereby stopping you out only for it to swing back up and make much profit. How do you strike a balance between your money management limit and the possibility of the price crossing your limit and swinging back in the opposite direction? Stochastic Momentum Indicator Index. Momentum indicators help to catch that "Here and Now" time to place orders and lock in profits. Thank you Atar atargeffen gmail.

Good study habits are a must for anyone who. wishes to achieve great success in their courses.

Potential outcomes: Avoid second-guessing the result of your dissertation.

In our next lesson we will put all of this to good use making variable sandwiches.

The energy source that the body receives is significantly important in how the body reacts.